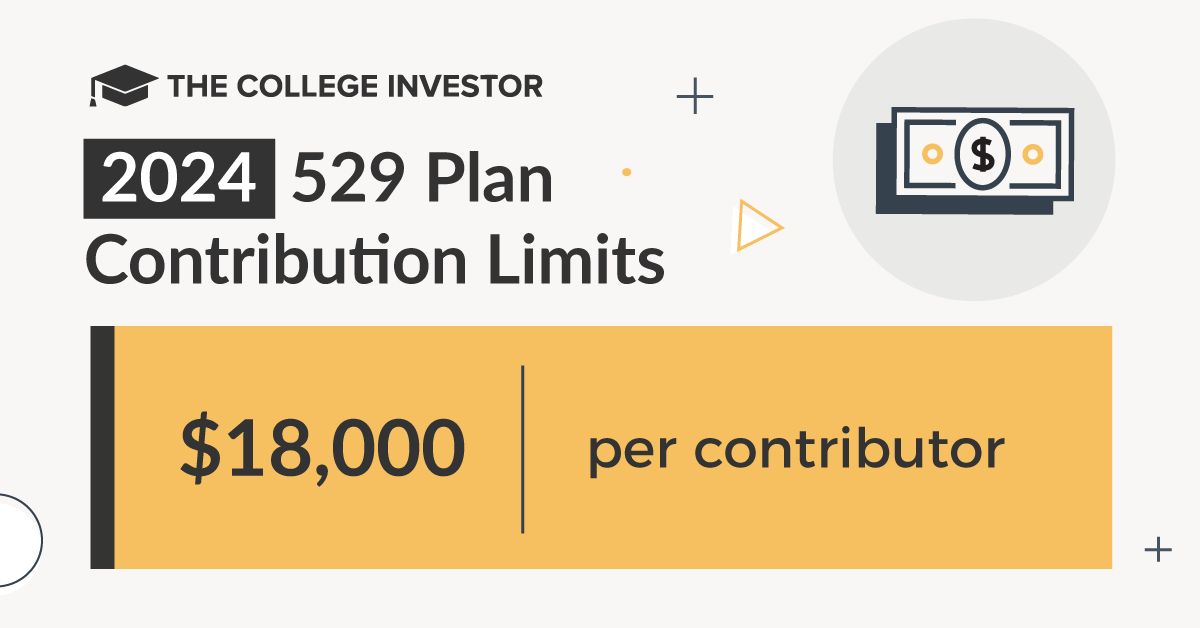

Annual 529 Contribution Limit 2025 - 529 Plan Contribution Limits Rise In 2025 YouTube, Since each donor can contribute up to $18,000 per. In 2025, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709. Annual 529 Contribution Limit 2025. 529 plans do not have an annual contribution limit. It’s important to note that these caps are subject.

529 Plan Contribution Limits Rise In 2025 YouTube, Since each donor can contribute up to $18,000 per. In 2025, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709.

* $17,000 for tax year 2025. 529 plans do not have an annual contribution limit.

529 Plan Contribution Limits 2025 Aggy Lonnie, * $17,000 for tax year 2025. In 2025, the annual contribution limits are $6,500 for beneficiaries under 50 years old and $7,500 for those over 50.

Roth Ira Contribution Limits 2025 Calculator Averil Mathilde, Each state sets a maximum 529 plan contribution limit per beneficiary. In this article, we’ll delve into the specifics of 529 plan contribution limits for 2025, providing a comprehensive guide to help you maximize your savings.

529 Limits 2025 Elset Horatia, Most people limit their annual 529 plan. Nps contribution limit for employer in private sector raised from 10% to 14% of the employees basic salary.

Max 529 Contribution Limits for 2025 What You Should Contribute, In 2025, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709. Knowing how to open a 529 account can help you effectively.

You also need to do this strategically as you cannot rollover an amount greater than the annual roth contribution amount, which in 2025 is $7,000.

Max 529 Plan Contribution 2025 Inga Regina, Each state’s 529 plan vendor sets its own aggregate contribution limit. 529 plan contribution rules and taxation the irs does not technically limit how much you can contribute to a 529 plan.

529 Plan Contribution Limits For 2025 And 2025, Good news, while there is a maximum aggregate 529 plan contribution limit, there is no annual 529 plan contribution. What is a 529 savings plan?.

Irs 529 Contribution Limits 2025 Rory Walliw, What is the maximum annual 529 plan contribution limit? * $17,000 for tax year 2025.

2025 Vs 2025 Hsa Contribution Limits Lynne Rosalie, Annual contributions over $18,000 must be reported to the irs. Since each donor can contribute up to $18,000 per.

Indiana 529 Contribution Limits 2025 Faythe Cosette, These rollovers are subject to the roth ira's annual contribution limits. 529 plans do not have an annual contribution limit.

Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.