Corporate Tax Filing Deadline 2025 - News, The due date for the deposit of tax deducted/collected for june 2025. Annual tax returns for companies encompass two filings: The deadline for filing tax returns for the third tax period is set for the end of december 2025.

News, The due date for the deposit of tax deducted/collected for june 2025. Annual tax returns for companies encompass two filings:

Corporate Tax Ministry of Finance United Arab Emirates, If you’re a c corporation or llc electing to file your taxes as one for 2025, your corporate tax return is due on april 15th, 2025—unless. Missing deadline incurs penalties under section 234f.

What Do I Need to Know About the New Tax Filing Deadline? LP, Unless special rules apply, a corporation generally adopts a tax year by filing its first federal income tax return using that tax year. During this period, it is recommended that.

3 Ways for Fast and Easy Filing This Corporate Tax Season 2022, If you’re a c corporation or llc electing to file your taxes as one for 2025, your corporate tax return is due on april 15th, 2025—unless. Here are the crucial filing deadlines:

LLC Tax Filing Deadline Small Business Tax Deadlines for 2025, The due dates for these 2025 payments are april 15, june 17, september 16, and january 15 (2025). For the financial year that concluded on 31 march 2025, the deadline for individuals to submit their income tax returns (itrs) is on july 31, 2025.

Q&A Can I file a second IRS tax deadline extension for my corporate, Unless special rules apply, a corporation generally adopts a tax year by filing its first federal income tax return using that tax year. 301 rows the tax return must be filed at the latest on 30 september of the tax year for financial years ending between 31 december of the previous year and the last day of february of the tax year.

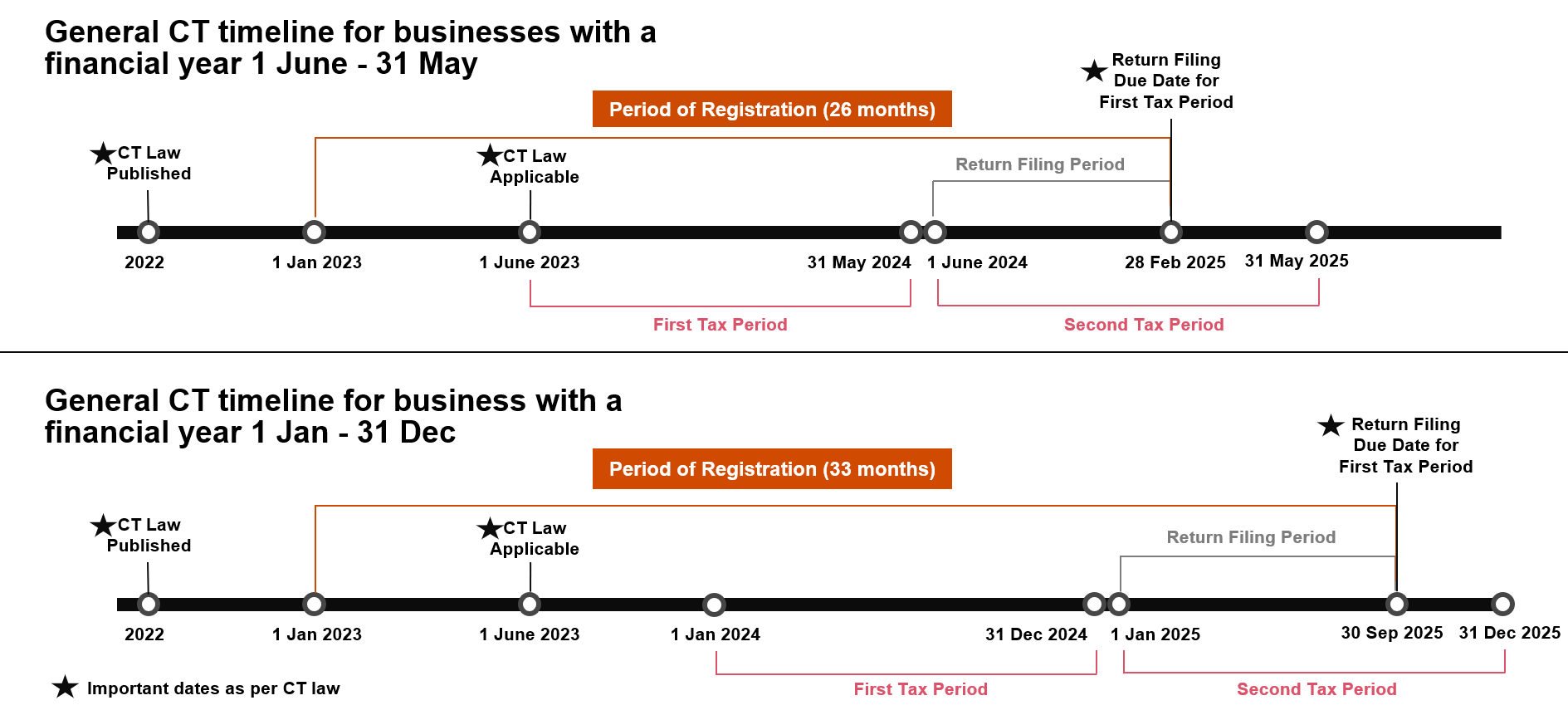

A Guide to UAE Corporate Tax Registration and Filing Timeline, Estimated chargeable income and corporate income. 301 rows the tax return must be filed at the latest on 30 september of the tax year for financial years ending between 31 december of the previous year and the last day of february of the tax year.

Disaster Relief has Extended Some Corporate Tax Filing Deadlines, During this period, it is recommended that. The due date for the deposit of tax deducted/collected for june 2025.

You have right up until tax day to file for. When the corporation’s tax year ends on the last day of a.

Corporate Tax Filing Deadline 2025. The 2025 deadline to file individual. Tax return deadline for corporations.

Corporate tax filing deadline YouTube, Corporations are required to file their t2 corporate income tax return within six months of their tax year ending. Companies and llps should take care and adhere to the compliances within the.

Corporation Tax filing deadlines and reminder about recent, During this period, it is recommended that. A corporate taxpayer is required to file an annual tax return (generally form 1120) by the 15th day of the fourth month following the close of its tax year.